September 11th, 2015 by dustysmithteam

If you see a haze of condensation on your window, should you be

concerned? Maybe. Maybe not. It depends on a number of factors.

First of all, an occasional build-up of condensation is normal and often the

result of fluctuating humidity in the home. Usually, it’s nothing to worry

about. If you’re using a humidifier, try adjusting the levels. If the humidity is

being generated naturally, try placing a dehumidifier nearby. Also, remove

any plants and firewood from the area, as they can release a surprising

volume of moisture into the air.

Do you see moisture in between the panes of glass that make up the

window? If so, that means the seal has failed and moisture has crept in.

Double and triple pane windows often contain a gas (argon, for example)

that boosts the insulating qualities of the window. When the seal fails, the

gas disappears, making the glass colder and often allowing condensation to

creep in. Eventually, you’ll want to get it replaced.

If you see moisture build-up anywhere on the frame of the window,

particularly at the joints, that could be a sign of water leaking through. That’s

an issue you should get checked out immediately by a window contractor.

Posted in Uncategorized | Comments Off on Concerned about Condensation on Windows?

August 18th, 2015 by dustysmithteam

Say you’re viewing a home and are impressed with how it looks. The walls

are freshly painted. Everything seems bright and new. You’re considering

making an offer.

Then, while standing on a mat in the kitchen, you hear a squeak below your

feet. You lift the mat and see that some tiles are broken. Obviously the mat

was there to, literally, cover up that defect.

A few broken tiles are not a big deal. But now you’re thinking, “What else

might be wrong with this house?”

There’s no reason to worry that every home will have maintenance issues

hidden from view. However, it’s smart to do your due diligence to ensure the

home you’re considering is truly as good as it looks.

One way is to have a professional home inspector check out the property as

a condition of your purchase offer. He or she will inspect the home from top

to bottom, inside and out, and point out any issues you should address.

It’s also smart to ask questions. Find out the age of certain features, such as

the roof, furnace, and appliances. Ask about any recent renovations, and

determine whether they were done by a professional or by the homeowner.

Most importantly, work with a good REALTOR® who can provide you with

information on the property that you would have difficulty getting on your

own. Your REALTOR® has a stake in making sure you buy a home with

your eyes wide open — knowing all the potential maintenance issues you’re

likely to encounter.

Want to talk to a good REALTOR®? Call today.

Posted in Uncategorized | Comments Off on Discovering that a home you like has “issues”

July 2nd, 2015 by dustysmithteam

There are many reasons why you may need to sell your home quickly: a

sudden job relocation; a change in family situation; or perhaps an

opportunity to purchase a new home that you just can’t pass up.

Whatever the reason, this strategy will help when you need to sell fast. It’s

called the “3 Up” strategy.

• Fix it up.

• Clean it up.

• Spruce it up.

First, you need to fix it up. That simply means getting things repaired around

your property, such as a broken floor tile in the kitchen or a sticking patio

door that’s difficult to open and close. Maintenance issues like these distract

buyers from the appealing qualities of your home. Fortunately, repairs can

usually be done quickly.

Second, clean it up. Obviously, when your home is clean and tidy it’s going

to look its best. You also want to eliminate as much clutter as possible. You

don’t need to make every room look like a magazine cover — but that’s a

good attitude to have when prepping your home for a quick sale!

Finally, spruce it up. That means making any quick improvements that are

going to make your home even more appealing. It might mean replacing the

kitchen counters or giving the main rooms a fresh coat of paint.

Of course, the number one strategy for getting that SOLD sign on your front

yard is to select a great REALTOR®.

Looking for a great REALTOR®? Call today.

Posted in Uncategorized | Comments Off on The “3 Up” Strategy for Selling Your Home Quickly

May 29th, 2015 by dustysmithteam

When you’re thinking of selling your home and buying another, you face the

inevitable question: Should I list my property first or buy my new home first?

Let’s take a look at both options.

If you attempt to buy a property before listing your home, you run into a

couple of challenges.

First, sellers may not take you seriously as a potential buyer. After all, you

haven’t put your own home up for sale. As far as they’re concerned, you

might merely be testing the market.

Second, your property might not sell as quickly as you thought it would. If

there is an early closing date on the home you purchased, you might end up

owning, and paying a mortgage on both properties, at least until your home

sells.

If, on the other hand, you list your property before buying a new home,

sellers will know you’re serious. That puts you in a competitive position in

the event of multiple offers.

Also, if your home sells quickly, you’ll have the peace-of-mind of knowing

exactly how much of a new home you can afford. You’ll be able to shop with

confidence.

Of course, like the first option, there is a chance that the closing dates won’t

match and you’ll end up owning two properties for a period of time.

However, solutions such as bridge financing are available to help.

So, there is no perfect answer. A lot depends on the state of the local

market.

Looking for a good REALTOR® who can help you decide which is the best

move for you? Call today.

Posted in Uncategorized | Comments Off on Should You Sell First and Buy Later? Or Vice-Versa?

May 26th, 2015 by dustysmithteam

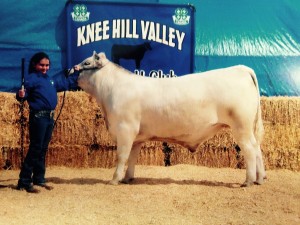

The Dusty Smith Team is a pro ud supporter of the Innisfail and District 4H sale last night with the purchase of Rayne Dallas” steer!

ud supporter of the Innisfail and District 4H sale last night with the purchase of Rayne Dallas” steer!

Posted in Uncategorized | Comments Off on Proud supporters of the Innisfail and District 4H sale!

April 30th, 2015 by dustysmithteam

Closing day is an exciting time. After all, you’re moving into your new home!

However, it can be stressful as well. The last thing you need is to be

confronted with something you don’t understand. So here is a quick list of

common “closing day” terms.

• Disbursements. This is the allocation of funds to the appropriate

parties, such as the seller. Your lawyer will take care of this for you.

• Possession. This is the moment on closing day when you are legally

able to take possession of your new home. It’s usually when your

REALTOR® or lawyer hands you the keys.

• Title. This is a legal document that identifies the property and its owner.

• Closing costs. These are expenses, excluding the selling cost of the

property, that are due on closing day, such as legal fees, reimbursement

for pre-paid utilities, utility deposits, insurance, and taxes.

• Closing adjustments. These are expenses pre-paid by the seller that

need to be reimbursed on closing.

There may be other terms you come across on closing day as well.

Don’t worry, a good REALTOR® can help make the day go smoothly

for you and your family.

Looking for a good REALTOR®? Call today.

Posted in Uncategorized | Comments Off on “Closing Day” Terminology You Need To Know

April 7th, 2015 by dustysmithteam

Usually when you list your home, you would prefer to sell it quickly. It’s like

being the first one served at a crowded ice cream parlour. It’s satisfying.

However, sometimes there’s more to it than that. There may be a truly

urgent reason why you need to find a buyer for your property as soon as

possible, such as a sudden job relocation.

If that’s the case, it’s important to explain your situation to your REALTOR®,

who will be able to put together an action plan for selling your home quickly

and for the best price possible.

During that conversation, ask what you can do to help the process along.

For example, you may be able to:

• Spread the word to your friends and other connections on Facebook.

• Canvass your neighbours and tell them about your listing.

• Stage your home so that it’s more attractive to prospective buyers.

When it comes to price, be prepared to be flexible. That doesn’t mean you

must settle for a price far below your home’s market value. However, you do

need to be prepared to accept a good offer rather than try to hold out for a

great one.

Also be open to as many viewings and open houses as possible. Having

many prospective buyers come through your home within a short period of

time may be a little inconvenient, but the payoff might be an offer!

Finally, work with your REALTOR®. A good REALTOR® will know the local

market well and have many ideas for selling your property fast.

Looking for a good REALTOR® like that? Call today.

Posted in Uncategorized | Comments Off on How to Help Sell Your Home Quickly

February 27th, 2015 by dustysmithteam

If you’re thinking of shopping for a new home, one of the first considerations

is price range. You want to know what you can reasonably afford.

How do you figure that out?

First of all, you need to determine the initial out-of-pocket costs you will

need to cover. There are often more costs associated with purchasing a

home than its actual price. You need to take into account such additional

expenses as moving costs, legal fees, and a home inspection, not to

mention the costs of prepping your current property for sale.

Experts say you should budget 5-10% above the purchase price for these

items. So if you can afford to spend $470K on a new home, you should be

shopping in the $425-445K range.

Another factor to consider are the potential proceeds from the sale of your

current home. Your REALTOR® can help you determine how much your

property will likely sell for in today’s market. Any existing mortgage will need

to be subtracted from that amount to determine how much cash will be left.

Of course, you should speak to a mortgage broker or lender who can

compute how much of a mortgage you qualify for. Remember, qualifying for

a big mortgage doesn’t necessarily mean you should have one. You also

need to consider your personal finances and desired lifestyle – and whether

or not having a large mortgage is a good idea for you.

Once you have gathered all of your information, you can add any potential

sale proceeds to the amount of mortgage you qualify for, add other sources

of cash available for this purpose and subtract 5-10% for initial expenses,

and you’ll have an idea of the price range you should be considering.

Finally, it’s important to take the time to decide what kind of home you want.

Do you want a large backyard with trees? A quiet, family-oriented

neighbourhood? Four bedrooms and a finished basement? Once you

decide what you want most in a new home, it becomes much easier to find

one that’s in your price range.

Posted in Uncategorized | Comments Off on How Much of a New Home Can You Afford?

January 30th, 2015 by dustysmithteam

Sometimes we don’t have much choice about selling our home and buying another. Circumstances, such as a job relocation, may have made that choice for us.

However, most often the decision to move is discretionary. Sometimes people move simply because they think it’s a good idea. They feel that “now” is the right time to find their next dream home.

So how do you make that kind of decision?

There are, of course, many reasons to make a discretionary move. Usually, those reasons fall into one of two categories: need and want.

You may need to find a new home, for example, because you’ve outgrown your current property. Perhaps you have a growing family and require more space. Maybe you’re doing more entertaining and need a larger backyard with a more spacious deck. It could be that the commute to work is arduous and you need to move to a place that’s closer.

Those “needs” may motivate you to move, but sometimes a “want” plays an important role, too.

For example, you may want to live in a quieter neighbourhood or in a newly built home that requires less maintenance. Maybe you simply want a change.

If you’re thinking of making a move, take a moment to write down a list of your needs and wants. Seeing them on paper will help make the decision easier.

Looking for expert help? Call today.

Posted in Uncategorized | Comments Off on Deciding on the discretionary move

January 30th, 2015 by dustysmithteam

We are proud to be participating in a great community event this weekend, the Ronald McDonald Charity Curling Bonspiel! We are proud to be supporting sick children and their families while they stay at their home away from home.

Visit here for more information regarding this charity event!

Posted in Uncategorized | Comments Off on Ronald McDonald House Charity Bonspiel!